It was all about getting into something better than a Nissan, apparently.

You’d think after countless student loan horror stories from millennials and Gen Zers, car shoppers would generally, at the very least, be wary of signing any loans with heinous APRs, but such is not the case.

A Kentucky-based car salesperson, who goes by @chiNOTshy on Twitter, recently boasted about getting a 26-year-old woman approved for an $835 per month car loan that carries a 28% APR for a 2015 Audi (model not specified.)

To put that in perspective, the average APR for a new and used car in 2022 is roughly 4% and 5.5%, respectively.

Even at the height of inflation in the 1980s, car loan APRs only got as high as 17.5% APR.

28% is a seriously high APR!

Check out her tweets below. Mirror here, just in case she deletes her tweet.

Before y’all get my mentions hot. I tired to tell her just like I try to every other person that’s buys what they want vs what they can afford. This industry has shown me ego will out weigh common sense.

— Samurai Chi (@chiNOTshy) March 20, 2022

Argue wit ya board of education.

According to Chi, this woman wanted to upgrade to something better than her Nissan.

Nissans, specifically Altimas, have earned the reputation for not only being notoriously unreliable but cheap, not classy, and embarrassing to own.

This, unfortunately, generally influences a few Nissan owners to “upgrade” into something that’s not a Nissan, even if it means, in this case, signing an auto loan that has the potential to ruin you financially for several of the most important years of your adult life.

The most common used car auto loan length is 72 months (six years.)

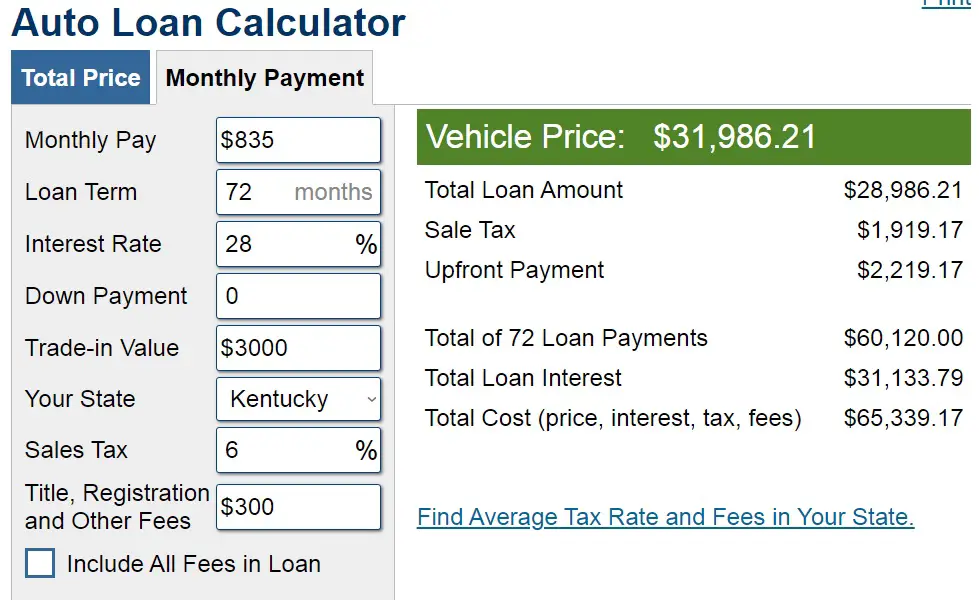

Estimating, with a generous $3,000 trade-in value for her Nissan plus zero down and doing the math (plugging in the numbers into an Auto Loan Calculator) Chi probably got her approved for a $30,000 loan.

But since a 28% APR is downright ridiculous, over six years her Audi will end up costing her more than $65,000 or over $31,000 in interest alone.

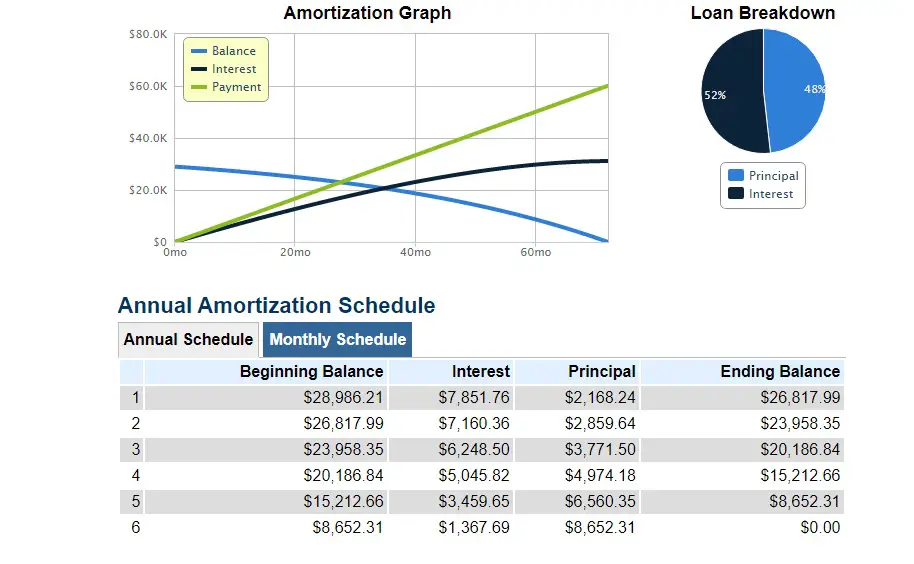

Here’s the amortization schedule per year.

Here’s where I got the above numbers if you want to see the monthly breakdown.

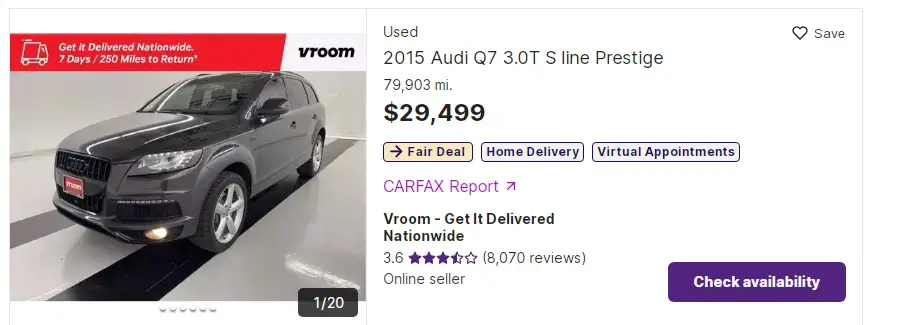

Here’s what that kind of money gets you in Kentucky if you’re shopping for a 2015 Audi.

As to her financial situation, Chi had this to say.

What’s so funny is the girl makes very good money and the better option I suggested to her, she turned her nose up at.

— Samurai Chi (@chiNOTshy) March 20, 2022

All y’all mfs with capes for her in my mentions mad at me meanwhile she’d call y’all POOR. To you face. ?

In hindsight, most people reading this blog post will see how poor a financial decision her 2015 Audi is.

Audis are also not exactly Toyotas and will require several thousands in maintenance is she plans to own it for several years.

But, as Chi mentions, all that matters to this Gen Zer is that “affordable” monthly payment and she’s no longer driving a Nissan.

This auto loan, on top of countless other examples, is why everyone should have a basic understanding of how student, car, and home loans eventually play out month over month.

By 26, I refuse to believe she didn’t have an inkling her auto loan terms are disastrous, but, then again, a lot of people are financially illiterate.

And although Nissans aren’t exactly a status car, when you’re in your 20s and 30s, aka the formative years of your financial future, status should be the least of your financial priorities.

If your current car somewhat reliable and isn’t a financial hindrance, “who cares” should be your philosophy about what you drive.

Because by the time this Audi is paid off, assuming she keeps up with her payments through 2028, I’m fairly sure she’ll have regretted her decision.

That is, if she didn’t roll over her horrible auto loan into something newer.

What are your thoughts on this auto loan example?

Do you think this Chi should’ve not approved such a horrible loan for her?

Or, should people be allowed to make their own financial mistakes, however bad.

[…] A great example is this car salesperson from back in March who sold a 2015 Audi to a former Nissan owner who agreed to an $835 monthly payment wi… […]