Even if you qualify for a 0% interest loan, this is how those loan companies make money anyway.

One of the largest purchases you can make as a car owner is buying wheels, tires, or both at the same time.

Some car enthusiasts don’t need new wheels and tires, but upgrading them is all part of the fun.

While others are just doing their due diligence, replacing their tires per their maintenance schedule or buying a new set because they ran over a mattress frame on the freeway. (ask me how I know.)

Regardless, wheels and tires cost a lot of money.

A recent trend in purchasing wheels and tires is an option to “Buy now, Pay later.”

What was once a big hit to your wallet is divided up into manageable payments over several months.

So, what’s the catch?

There are two ways loan companies, like Affirm, AfterPay and Klarna, make their money and, even if you qualify for a 0% interest loan, they’re getting paid regardless.

Here’s how.

“Buy now, Pay later” loan companies make money through the customer.

The first way BNPL loan companies make money is approving you for a loan with an interest rate anywhere between 0-30%.

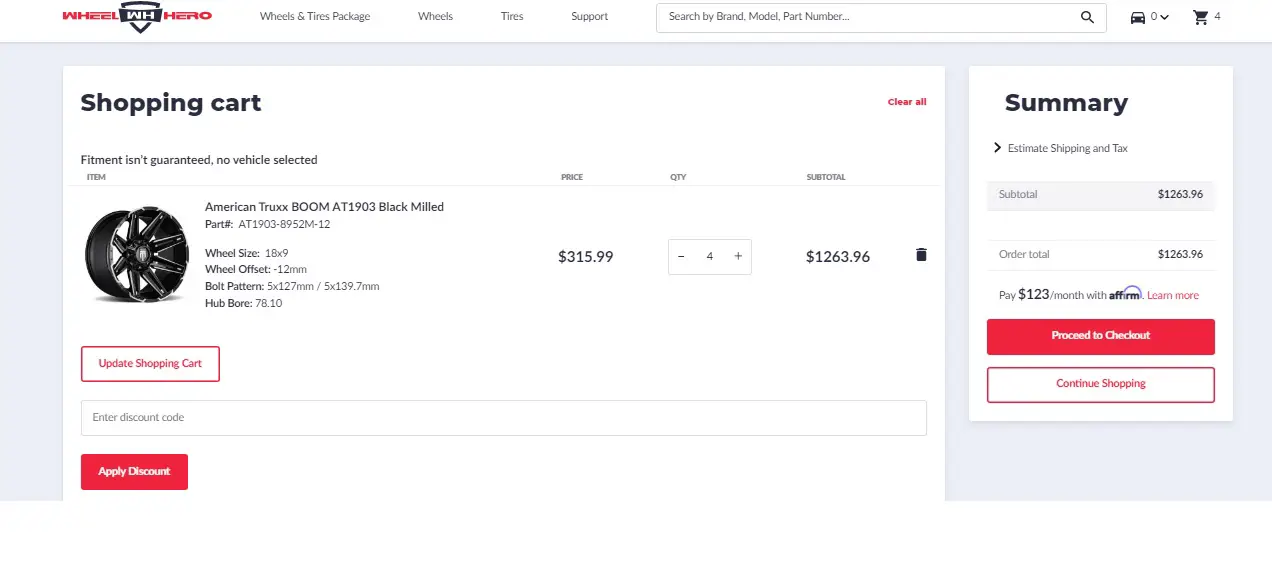

Take, for example, these four American Truxx wheels from Wheel Hero.

Spending $1,263.96 all at one time is a tough pill to swallow but, because I can choose to pay with Affirm, I can literally buy all four wheels for as low as $122.93 a month.

AND if I don’t need to apply any down payment, I can oftentimes not pay one cent of my own money at the time of checkout.

The first loan payment to Affirm will b edue 30 days or one month after my purchase date.

The catch is, it’s hard to qualify for a 0% interest loan.

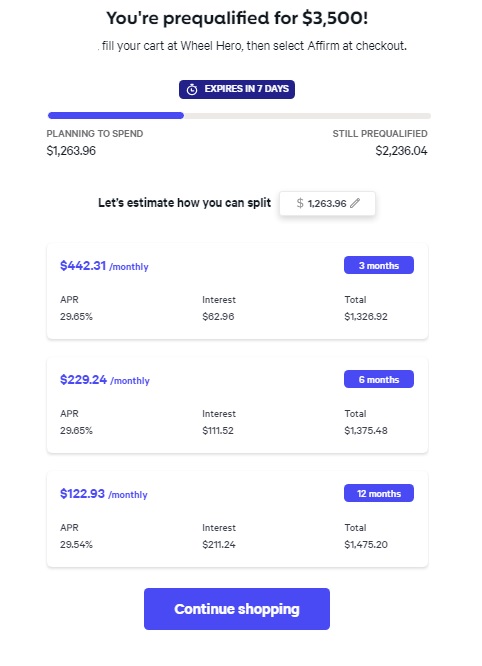

Here’s the loan I’m pre-qualified to use through Affirm after they do a soft-pull on my credit.

All three loans, from 3-12 months, carry a hefty 29% APR interest rate.

Affirm is transparent.

While I might choose to pay off my approved loan for $1263.96 at $122.93 a month, over a year I’ll end up paying $211.24 extra.

In total, I’m paying Affirm $1,475.20..

“Buy now, Pay later” loan companies make money on the other side of the deal, through the business using their service.

There are times that, if you have exceptional credit and make enough, you’ll qualify for a 0% interest loan.

If you need to buy $1200 worth of tires, choose to finance through a BNPL loan company and qualify with 0% interest loan over 12 months, you’ll pay exactly $100 a month.

At the end of 12 months, you’ve only paid $1200 exactly.

Where does Affirm, AfterPay, or Klarna get its cut?

From the business.

According to Merchant Maverick,

“…Merchants pay a percentage of each sale to Affirm, typically around 6% plus a transaction fee of $0.30, although those figures may vary.

That transaction fee varies between different BNPL loan companies but, you get the picture.

Their justification charging merchants is the sale would’ve never happened if they never offered their service, therefore they deserve a cut.

While you might not pay extra on those $1,200 tires, the tire shop has to pay the BNPL loan company $72.30 ($72 for their 6% cut and a .30 transaction fee.)

Conclusion

If you’re financially responsible and the type of person who pays everything on time, buying wheels and tires through a BNPL loan company is always an option if disposable income is tight at the moment.

But, if you’re truly irresponsible and reckless with your money, for the love of God, stay away from paying for your wheels and tires with a payment plan.

While these loan companies won’t report to credit agencies if you pay off your loan as planned, if you fall behind on payments and default on your loans, they WILL report you to the appropriate credit agencies and send your accounts through collections.

How sad is it you wrecked your chances for qualifying for a decent home or car loan years later because you couldn’t pay for your truck wheels all at one time.