I asked some of my most successful friends what the best credit cards for gas are and these are their recommendations.

When it comes to saving at the pump, using a credit with good cash back rewards is almost a must nowadays, especially considering you’re going to spend money on gas anyway.

Embed from Getty ImagesOn top of that, with the rise of digital crimes at the pump like credit card skimmers, credit cards offer another layer of security between your transaction and your money in the bank.

To find out what are some of the best credit cards for cash back rewards specifically for gas, I polled a group of some of my most successful friends to find out what was in their wallets to maximize their gas savings.

These are some of their best recommendations.

Citi Custom Cash Card- 5% Cash Back

Link for credit card details: www.citi.com

If you’re someone who spends a lot on gas a month, the Citi Custom Cash Card with up to 5% cash back on eligible categories might be for you.

According to Citi, “Earn 5% cash back on purchases in your top eligible spend category each billing cycle up to $500 spent and 1% cash back thereafter.”

Gas purchases are one of the eligible categories.

On top of that, there’s a $200 cash back bonus if you spend $750 on purchases in the first 3 months of opening your account. Most credit cards with that high of a cash back bonus push you to spend up to $1000 over three months to qualify.

Cash back rewards are capped at the first $500 on your top category, but considering most Americans only spend up to $250 on gas a month, that’s more than enough for the majority of drivers.

Costco Anywhere Visa Card by Citi- 4% cash back

Card details: www.costco.com

The Costco Anywhere Visa Card by Citi is only available to Costco Club Members but, if you’re already a member who buys gas there, you should definitely sign up for this card.

According to Costco that’s, “4% cash back on eligible gas for the first $7,000 per year, and then 1% thereafter.”

There’s also 3% cash back on restaurants and travel, 2% cash back on Costco purchases, and 1% cash back on everything else.

Combine that 4% cash back with consistently the cheapest gas around and you have a 1-2 punch combo to getting the cheapest gas in town.

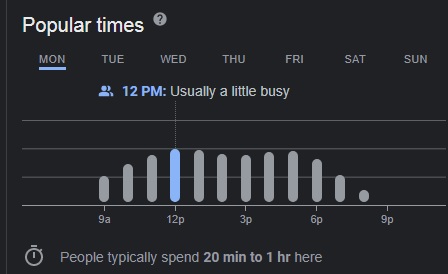

Pro Tip: The one drawback of buying Costco gas is the lines. But, if you have time in your schedule to plan out when you go, if you look up your Costco on Google, you can figure out the best times to go to avoid long lines.

Here’s how busy it gets at my local Costco when I wrote this blog. If you go early in the morning or late in the evening before closing on a weekday, that’s when lines are not that bad.

Bank of America Customized Cash Rewards Credit Card- 3%-5.25% cash back on gas

Card details: www.BankofAmerica.com

The Bank of America Customized Cash Rewards Credit Card already starts out with a generous 3% cash back in the category of your choice (gas included.)

The only stipulation is those earnings are capped at 3% and 2% cash back on the first $2,500 in combined choice category/grocery store/wholesale cub purchases in a quarter. Then, it’s 1% thereafter.

But, if you’re a Bank of America Preferred Rewards Member, that 3% cash back on the category of your choice can get as high as 5.25% depending on how much you have in the combined balances of your Bank of America deposit and/or Merrill investment accounts.

To get into Platinum Honors, the highest tier of Bank of America’s Preferred Rewards, you need a minimum of $100,000 in said accounts.

If you meet that requirement, you’re eligible for 5.25% cash back on the category of your choice, one of the highest gas cash back percentages around.

PNC Cash Rewards Visa Credit Card- 4% cash back

Credit Card Details: www.pnc.com

PNC’s Cash Rewards Visa Credit Card is one of my favorites because it offers a competitive 4% cash back on gas without making you jump through hoops to qualify.

You don’t need to be a member of anything or have a certain amount of money in the bank to qualify for that high cash back percentage, you just need to qualify for the card (obviously.)

According to PNC, “Earn 4% cash back on gas station purchases, 3% cash back on dining purchases at restaurants and 2% cash back on grocery store purchases for the first $8,000 in combined purchases in these categories annually. You’ll earn at least 1% cash back on all other purchases everywhere, every time.“

This particular PNC card might not be available in your state, but if they let you apply, you’re eligible.

It happens to be my everyday credit card so I’m a little biased towards this one.

Chase Freedom Unlimited and Freedom Flex Credit Card- 5% cash back

Credit card details: www.chase.com

Note: This 5% cash back on gas offer is available only for the first year of card use. Regardless, it’s one of the best cash back percentages around.

According to Chase, their new card member offer is as follows, “Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening. And earn 5% cash back on gas station purchases on up to $6,000 spent in the first year.”

To maximize this offer, that works out to $500 a gas a month. That’s a potential $300 in cash back from your gas purchases in one year alone.

Not bad.

Abound Credit Union Visa Platinum Credit Card- 5% cash back unlimited

Credit Card details: www.aboundcu.com

This one’s a bit of a dark horse but, as I understand, there’s no limit to the 5% cash back on gas (which shows up on your statement as a discount on gas purchases.)

You will have to jump through two hoops to get this card.

Hoop 1– You must be a Credit Union member to apply for this card. Although their Membership requirements read like you have to either be a Kentucky resident or active/retired military to apply, according to Deposit Accounts, you can select other in your membership application under eligibility requirements. tl;dr- anyone can apply?

Hoop 2– Next, you must have a Credit Union Savings Account. According to this Reddit post, that means a one time $10 membership fee and a minimum $5 Credit Union Savings account balance.

If you become a credit union member and qualify for their Visa Platinum Credit Card, unlimited 5% cash back on gas might make this card be the best credit card for gas out there.

Conclusion

Unless you have an EV or use public transportation, you’re going to buy gas.

If that’s a given, why not save a bit, anyway?

It’s worth noting that these benefits only work if you pay off your balance every month, no ifs, ands, or buts.

Once you start incurring interest because you carry a balance, those savings at the pump quickly disappear, making this whole gas saving business moot.

Do you have any other Credit Card recommendations for gas?

Let me know in the comments below.

[…] while anyone can find a decent credit card that gives them a decent 3%-5% back on your gas purchase, PNC’s making their Cash Rewards Visa credit card with available 4% cash back on gas even […]