In this crazy car market, close to $800 a month for 84-months doesn’t sound too farfetched.

If you think your auto loan is bad, wait till you see what Florida City resident Christopher Shannon’s family has been going through.

Shannon took to Facebook, simultaneously congratulating and roasting his family members by not only sharing what car they drove off the lot in, but the shockingly embarrassing financing terms they agreed to.

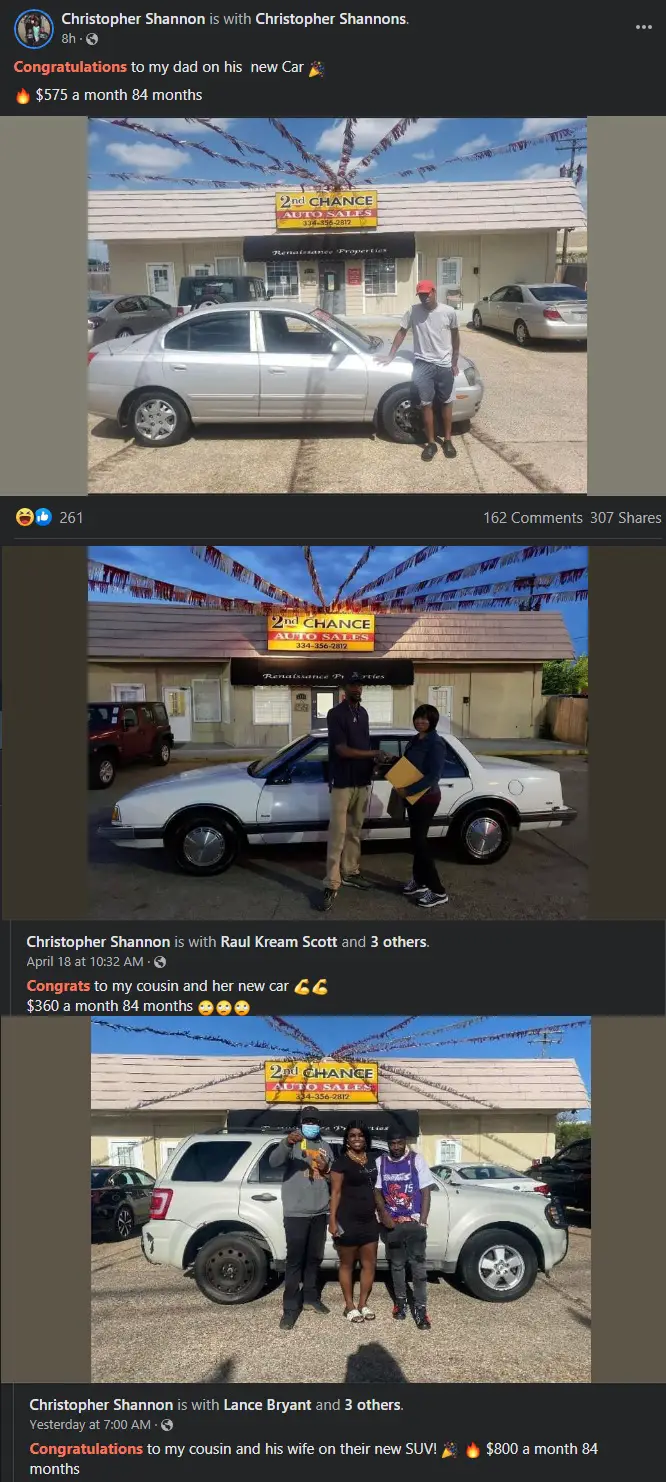

Here are screenshots of Shannon’s viral posts below.

The photos show Shannon’s supposed family members standing outside 2nd Chance Auto Sales, a used car dealership in Montgomery, Alabama.

As his captions read, the auto loans his family members agreed to are hard to believe.

Take that Ford Escape financed at $800 a month for 84 months, that works out to $67,200 over the life of the loan…for a used crossover from the mid-2000s.

Shannon’s posts even inspired at least one copycat.

If you haven’t figured it out already, all of Shannon’s posts are not real and are, in fact, just jokes.

Shannon’s posts got so out of hand, 2nd Chance Auto Sales themselves made their own post denouncing anything Shannon posted, stating they’d never publicly share the financing terms of their customers.

As proof, here’s the real photo source of that Challenger deal.

Behind every good Internet meme/joke is a kernel of truth.

While 2nd Chance Auto Sales wouldn’t seriously make (I hope) an egregious auto loan totaling over $67,000 for a Ford Escape, the truth of the matter is, some used car dealership loans agreements are truly awful.

For a lot of drivers stuck living paycheck to paycheck, often with sub-prime credit, that need a car yesterday, used car dealers, aka B.H.P.H lots (or Buy here pay here) are often their only option.

The worst part is, used car dealers know this.

According to Real Car Tips on shady used car dealerships,

“…the dealer will arrange financing and maximize every ounce of profit available. They will jack up the interest rate, stretch out the loan term as long as possible, and add-in as many extra products as they can (such as extended warranties) into the loan.”

“It’s not unheard of for dealers to make upwards of $10,000 in profit on just one customer.“

Not only are these type of auto loans legal and an everyday occurrence, it’s no longer shocking, but a badge of shame, for anyone who gets caught out agreeing to such a loan.

That’s why Shannon’s posts got so much attention, almost everyone knows someone who signed an auto loan just for that affordable monthly payment.

It’s also why 2nd Chance Auto Sales had to squash any rumors so quick.

I do find it worrying 2nd Chance Auto Sales only denounced they don’t reveal financing terms, but not the ridiculous nature of the loans itself.

Regardless, no, those posts with ‘out of this world’ auto loan terms showing 2nd Chance Auto Sales customers aren’t real.