You’ll never guess how much these Toyota techs owe to their local Snap-on truck

You’ve heard about how technicians can’t step on a Snap-on or Matco truck without buying a tool, a set of whole, or a whole daggum rolling cart.

Like buy now, pay now lots,” Bad credit? No credit? No Problem!”

Snap-On trucks will extend you a line of credit to pay off thousands of dollars in tools because not only do they know you have a job, they know where you work and come there often.

But, how bad can it get?

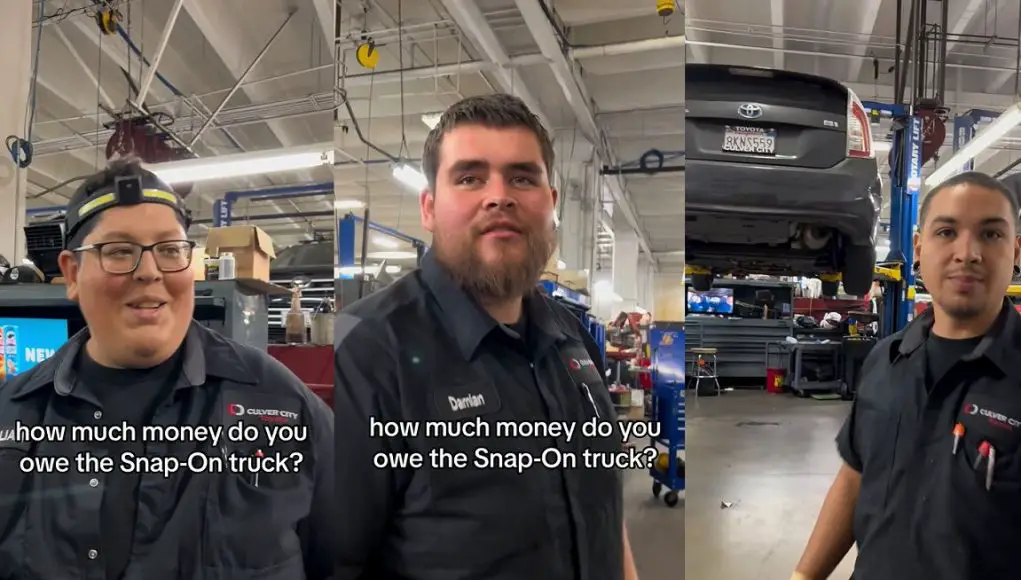

The social media team at Toyota of Culver City, CA took a few minutes out of their day and asked their techs just how much in debt they are to their local Snap-On truck and I’m shook-eth.

Check out their video below.

Here’s their responses below.

“How much money do you owe the Snap-On truck?”

Tech 1: ” Too much, like $6,000.”

Tech 2: “About $10,000.”

Tech 3: “Not a lot. Probably like $5,000”

Tech 4: “Right now? Probably like $15,000.”

Tech 5: ” Probably my left leg. Hehe.”

While a left leg can fetch a couple thousand on the black market, that last tech likely means a lot.

And if you know how credit cards work, if that Culver City Snap-On truck is charging 19 percent APR interest like this Snap-On customer below, these Culver City techs will likely pay the same amount (or more) in interest to fully pay off the balance if they don’t pay it off in full ASAP.

So a buddy and I took a look at our snap on credit loans. For any new technicians, please use this info to keep from making the same mistakes we did. We were both told they would be 4 year loans, at 19 percent, we were not told that we would be charged 19 percent of the total loan per month!

byu/getgappede30 inJustrolledintotheshop

Depending on how good you are and how fast you work or how well the terms of your salary are, auto techs make good money and you gotta do what you gotta do (buying the right tools for the job) to get the work done.

Regardless, before you step on a Snap-On truck and buy tools, just know what your repayment terms are and how much you’ll end up spending total.

As they say, if the juice is worth the squeeze, and you’ll make more money with these tools, enough to cover the Snap-On loan (interest and all) and then some, then these Snap-On tools are worthwhile.

But, if they’re too rich for your blood, it’s time to find other more affordable ways to get quality tools at a price point you can afford.

Dear dumb a**es that fell for the snap on sells crap there if you are indebted to them you can’t purchase from no one else every time I had a broke tool they belittled what did you do to it also don’t buy there high ticket items you can’t repair them unless you let them to do it because no one else can supply parts and won’t they got you it’s all discontinued now please buy another further more from what I experienced mostly all snap on salesperson most ignorant and disrespectful you can still make money and go broke paying for a over price tools