Once you, the American Express Primary Card Holder sign up, the AU gets Premium Car Rental Protection as long as they activate it correctly.

A big perk signing up for any American Express Credit Card is their Premium Car Rental Protection.

For less than $25, any American Express Cardholder (yes, even their cash back cards with no annual fee) can sign up for Primary Car Rental Insurance for each rental with up to $100,000 in Theft/Damage Coverage on the rental car, not to mention up to $300,000-$500,000 total AD&D and Medical expenses coverage, too.

Note, this does not include liability, which you’ll either already have through your Primary Insurance or you’ll purchase separately through the rental car company.

But, what about authorized users? Do they get Premium Car Rental Protection too?

The short answer is yes, as long as they use their assigned authorized user American Express card to pay/pre-pay for the rental and sign the rental contract at the time of pickup.

Here’s how I found out.

My family and I are going on a series of trips this year, and we’ll be using car rentals.

My parents were always aware of rental car insurance offered through credit cards, but never really did research about it and instead just added the damage waiver at the time of pickup.

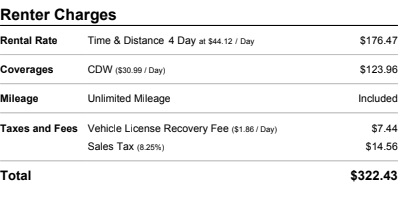

While convenient and the easiest in the event of a damaged rental, damage waiver fees can practically double the cost of a rental.

Here’s an example of just a four-day rental I had recently, the rental cost $170, but the damage waiver added $120.

As a responsible credit card user who’s, as of late, gotten interested in credit card perks, I finally looked into car rental insurance offered by CCs.

One of the best Credit Cards to offer rental car insurance is American Express.

As mentioned, all their cards, even their Blue Cash Everyday Card with no annual fee, gets rental car insurance.

What I found out is that the included car rental insurance is secondary.

That means, if you file an accident claim, American Express will go through your primary insurance first before covering any damages (up to their policy limit) not covered by your insurance.

With secondary insurance, after a claim, your primary insurance knows about it and your rates may go up.

American Express also offers cardholders Primary Premium Car Rental Protection for a one-time fee as a benefit.

If you have an accident with your rental (that’s not liability), and have Premium Car Rental Protection activated, you can file a claim with them directly, avoiding your personal car insurance entirely.

To take advantage of this, I signed up and got approved for an American Express Blue Cash Everyday Card (no annual fee) and added my Dad as an authorized user.

A few days later, both my Dad and I got our cards.

I then confirmed with an American Express representative over the phone that my Dad, an authorized user, will get Premium Rental Car Protection as long as I, the primary cardholder, sign up, and my Dad pays the rental with his AU Card and signs the rental contract when we pick it up.

The key is, Authorized Users must activate the Premium Rental Car Protection that you signed up for by

- Paying/Pre-paying for the Rental Car with their Authorized User Card.

- Signing the rental contract when they pick it up.

American Express benefits automatically trickle down to Authorized Users as long as they fulfill activation requirements.

You’ll get confirmation when you see the rental paid/pre-paid charge pop up on your American Express statement, including the Premium Rental Car Protection Fee that’s automatically charged after every eligible rental since you’re now in the Premium Rental Car Protection program.

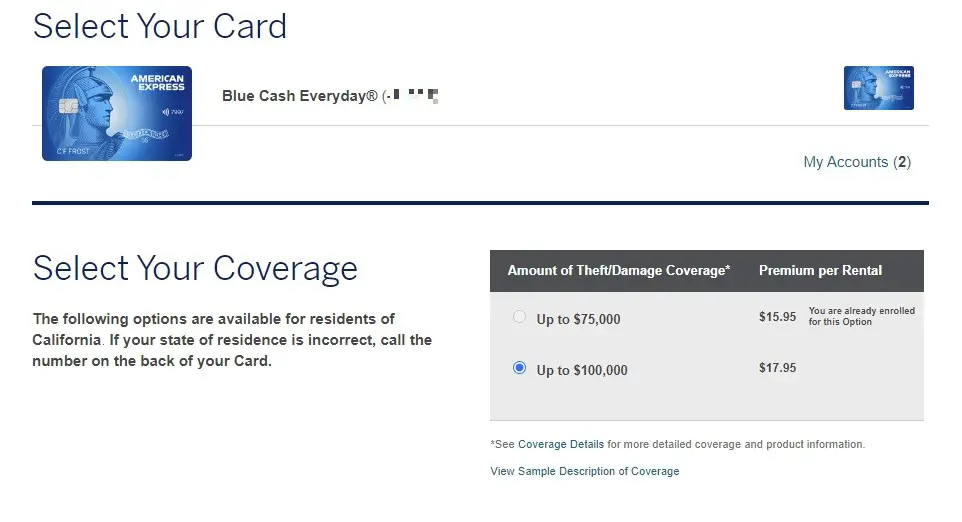

I then signed up for Premium Car Rental Protection for an upcoming rental.

As you’ll come to find out, if you select an authorized user card, you cannot sign up for PCRR, only the Primary Cardholder can.

Since the cars we rent are not all premium options, the cheapest option for $15.95 and up to $75,000 Theft/Damage coverage is good enough.

With Premium Car Rental Insurance activated for me and my authorized users (my Dad) I have the confidence to decline the damage waiver fee when I or my Dad rents a car knowing that I have American Express’s Premium Car Rental Protection as our primary car rental insurance.

I hope that makes it clear for you, your Authorized Users can get Premium Car Rental Protection for their rentals, too, as long as they pay for the rental with their assigned AU card and sign the contract.