This is how to fully depreciate your Aston Martin DBX just in your first year of ownership.

*Disclaimer: I’m not a tax expert and any advice I give you here might be inaccurate. Please consult with your local tax professional on how to proceed.

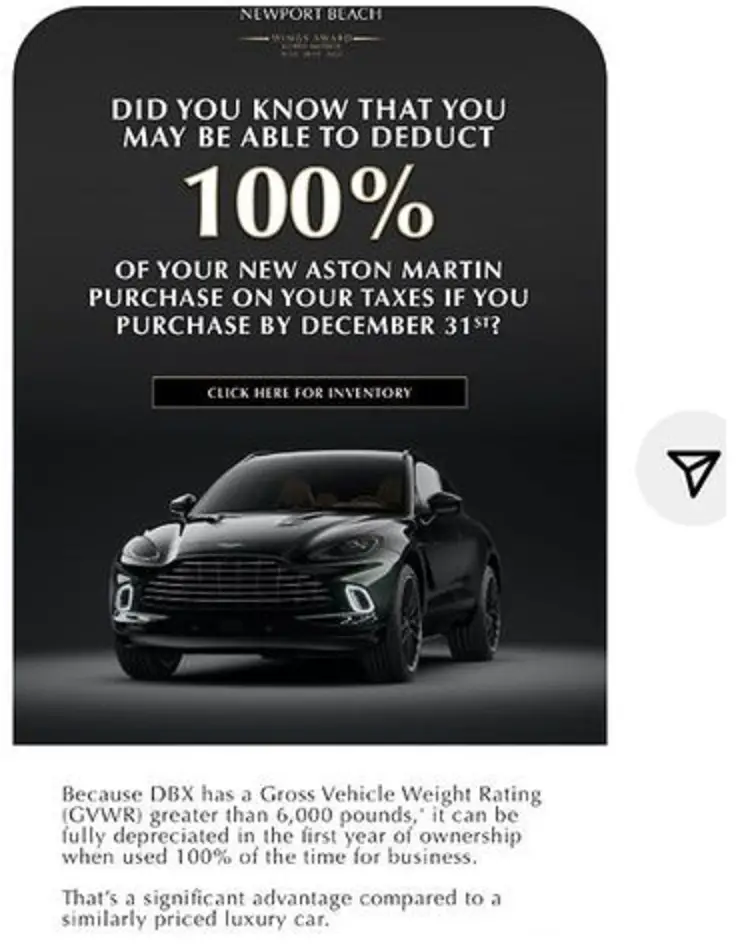

Are you someone with a legitimate business and are in the market for a luxury SUV? According to an e-mail sent out over the Aston Martin of Newport Beach’s e-mail list, a potential 100 percent tax write off for your first year of depreciation might be that tax incentive you need to get you in the driver’s seat of an Aston Martin DBX.

Here’s the e-mail in question.

Although the IRS severely kneecapped Section 179, limiting the maximum amount you can deduct for Vehicles (Heavy trucks and SUVs) with Gross Vehicle Weight Ratings 6,000 pounds and over to $25,900 (in 2020,) the same limit does not exist for an additional first year bonus depreciation for heavy vehicles.

Thanks to the Tax Cuts and Jobs Acts of 2017, under section 168(k) there’s an,

…unlimited 100% first-year bonus depreciation for qualifying new and used assets (including eligible vehicles) that are acquired and placed in service between September 28, 2017, and December 31, 2022.

This includes Heavy Vehicles or pickup trucks, vans, and SUVs with an over 6,000 pounds GVWR if “business related use exceeds 50%.”

To qualify for a 100% first year depreciation write off, you must claim and be able to provide evidence for 100% business use.

The Aston Martin DBX has a GVWR of 6,644 pounds and is eligible for a 100% first year bonus depreciation tax write-off under section 168(k.)

Given you legitimately use your DBX for business purposes, the potential tax savings are tremendous.

Take a 2021 Acura DBX listed for $188,888, with a 100 percent write off considering a 35 percent tax bracket, your DBX will end up costing you $122,777.

The Newport Beach Exclusive DBXs, at $240,000+, are potential Section 168(k) specials, too.

“the amount of allowable bonus depreciation is then phased down over four years: 80% will be allowed for property placed in service in 2023, 60% in 2024, 40% in 2025, and 20% in 2026.”

[…] last year, I blogged about how, since the GVWR of the 2022 Aston Martin DBX is over 6,000 pounds, if new DBX owners qualify, […]