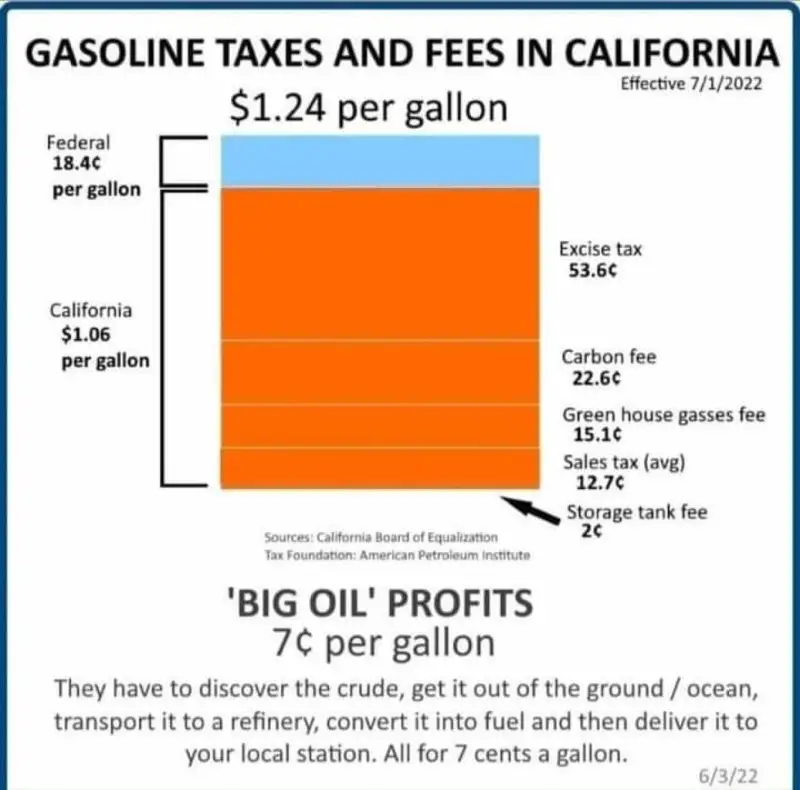

A chart titled “Gasoline Taxes and Fees in California” claiming that big oil makes pennies from all the work they do is classic misinformation.

There’s a chart circulating social media showing all the taxes and fees tacked onto a gallon of gas in California.

The graph is correct, as of this writing ($6.31/gallon in California) close to 20 percent per gallon is taxes and fees.

But, at the bottom of the graph is a quote saying,

“Big oil profits 7 cents per gallon.“

They have to discover the crude, get it out of the ground/ocean, transport it to a refinery, convert it into fuel, and deliver it to your local station. All for 7 cents per gallon.”

The quote reads like men risk their lives to explore, drill, and do so much physical labor, all for 7 cents a gallon and, how dare we demonize oil companies for alleged price gouging when clearly they’re working themselves to the bone to keep our nation running.

But, is that statement true?

Do they really only make 7 cents profit per gallon?

The answer is no, gas companies make a whole lot more than that.

Let’s dig into that.

Where is 7 cents coming from?

First, I could not find any data or figures from the chart’s sources or otherwise (searching online) that say gas companies make only 7 cents profit.

The 7 cents per gallon figure this chart is referring to is probably the station’s profit per gallon of gas.

The typical breakdown for the cost of gas reflects this.

Did you forget about the price of Crude? Yes you did. pic.twitter.com/fHmmCRegHQ

— Sigh Yents (@BendersCloud) June 21, 2022

Based on the national average of gasoline, after overhead, stations do typically make between 3-7 cents per gallon.

That’s already common knowledge, station owners make little on gas and instead make most of their profit selling drinks, snacks, and etc.

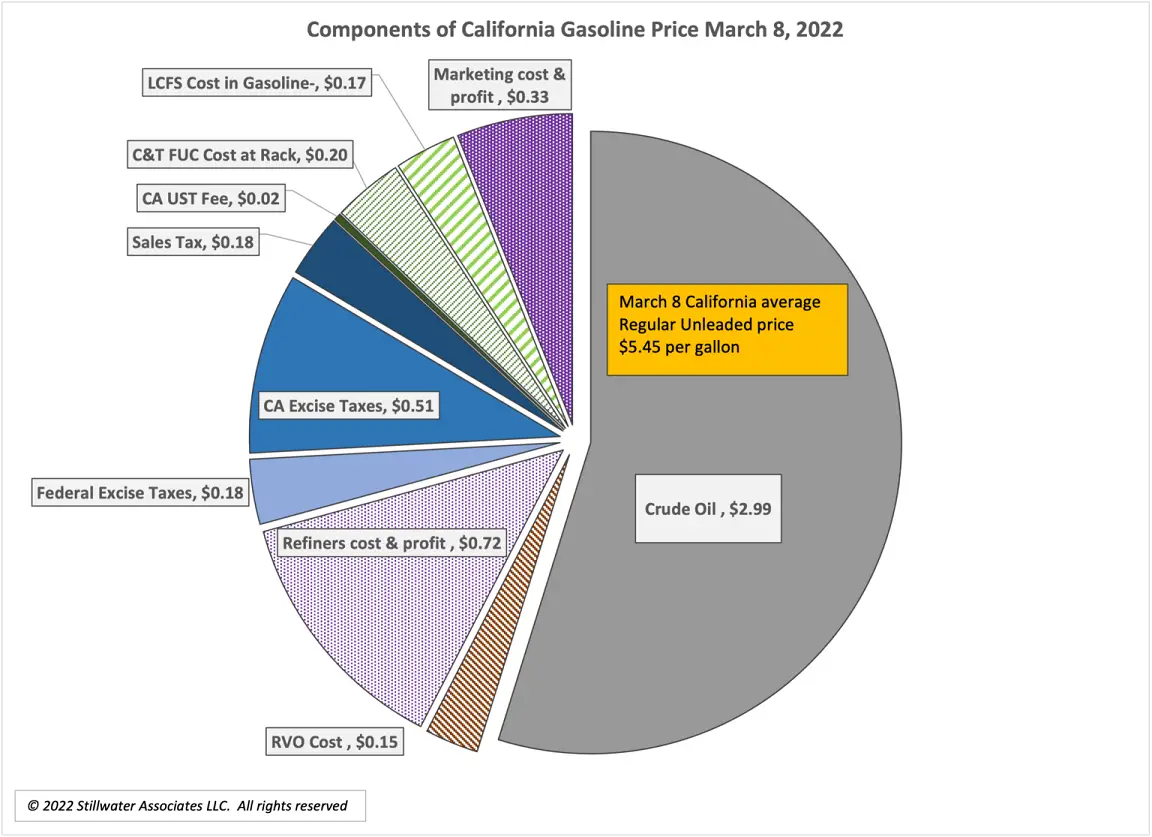

A more accurate chart

Next, that chart leaves out a lot of data, mainly, where’s the rest of the money?

Stillwater Associates, a transportation and fuel consulting firm, did a more thorough price breakdown of what makes up a gallon of California gas and, surprise, surprise, most of the cost of gasoline is crude oil.

Over 50 percent of what Californians pay at the pump goes to the crude oil suppliers. We’re talking about the Exxon Mobils, Shells, and BPs of the world.

How much of that $2.99 income is profit?

Yes, of course, oil companies are not in the business of selling crude oil for $2.99/gallon of gas without realizing a profit.

These are publicly traded companies and are beholden to their investors (i.e. capitalism.)

First, you have to realize that costs to produce oil are highly variable and depend on where you’re getting the oil.

“The cost to produce a barrel varies from about $20 per barrel in Saudi Arabia’s deserts to $90 per barrel for some deep-water wells.”

That’s not to say there aren’t industry averages for profit margins. However, with the high variability of the gas market, so to are the profit margins.

For example, we already know that, in 2020, gas companies were not making money on every gallon of gas sold and, in fact, had a negative profit margin.

But, today, gas companies are making a profit on gas.

According to Financial Data Vendor CSI, for Q1 of 2022 profit margins in the oil and gas industry is 12.47 percent.

For the sake of argument let’s assume a crude oil producer, who also owns its own refineries, only refines gas, and from every gallon of gas gets $2.99 per gallon from a California consumer in Q1 of 2022, with that profit margin big oil makes 37 cents profit.

Let’s say you drive a Camry with a 15.8 gallon tank size, minus one gallon for that emergency gallon when the light comes on, and, for every fill-up, on average $5.40 is going into the pockets of big oil.

Extrapolate that to how much gas Californians use in a day and you begin to understand how much big oil makes on every gallon of gas sold.

Conclusion

As oil companies continue to bring their refineries online and crude oil production continues to increase, in the short term we will see oil companies profit margins for the oil and gas industry well above 12.4 percent.

So no, oil companies do not make 7 cents per gallon of gas, that’s retailers.

As mentioned, in 2020, oil companies would’ve loved to make any kind of profit, even 7 cents.

But, today, they’re clearly in the black and, at least for Q1 2022 in California, about 37 cents per gallon is big oil profit.

All of your information indicated that the government will be paid more per gallon than the companies that do all of the work. I would also love to know what refineries are “coming on line “ since no refineries have been built in this country since 1978?

Let’s assume all the numbers listed in the above chart are correct. What you fail to point out is that “big oil” (a politically charged term) makes $.37 per gallon and does all the work, builds the infrastructure, and manages distribution. Government makes $.89 per gallon and doesn’t do anything. That is a serious disconnect.

Hey! Yeah! You guys are right! The CA government is only responsible for the 400,000 miles of road, the signage, the lights, the electricity to run said lights, the policing of, the petroleum oversight and enforcement, the emissions from the vehicles on them, the training, licensing and enforcement overseeing the drivers of said vehicles, and the infrastructure and personnel required to back the above! Why should they make more than the organizations paying $20-90 bucks a barrel who have to suck it outta the ground (or, more commonly, buy it overseas wholesale) and transport it, often using those self same roads to do so!? That’s outrageous!

What you listed…roads, bridges, lights, police, petroleum oversight. It should stop there. Government was never meant to be this big. All That has nothing to do with oil, except petroleum. Infrastructure is maintaining roads and bridges. How did you even link Police with oil?

Taxpayers.

How you get 12.47% from those numbers is beyond me. Must be that new math the ********are teaching today. Let me help you with these little things called numbers; assuming 5.40/gal and .37/gal profit (.37 / 5.40 = .068) which = 6.8%. So for every dollar the oil company collects 7 cents (.07 out of 1.00) is “profit.” Please provide me a list of other products and services which have that small of a margin? Hotels and hospitality have a gross margin of 76% (Net 8%); Tax services have a gores profit or 90% (net 20%) and I NEED a car to get to work, I can do my own taxes; According to financialrythm.com a study of 30 industries show Net profit margins greater than that 7%. The vilifying of oil and gas companies that provide an essential commodity (not just for energy to heat and cool houses, but cook food, produce products, and transport goods to market) that no one else can just pull out of their back pocket is ridiculous and disgusting and needs to stop. What is the profit margin on diamonds (talk about a USELESS “product”)? Where is the outrage on Patagonia’s B.S. support of “the environment” when 90% of their products (which means 90% of the source of their PROFITS) are either from petroleum by products or mining of metals that destroy the earth which these faux environmental activists express such concern for? Spare the intelligent among us your spin and your self righteous garbage rhetoric about exorbitant oil company profits. Without the oil companies you wouldn’t have a keyboard to hide behind or the electricity to post and transmit your absurdities.

Government taxes and fees still exceed the profits earned by the oil companies. This amounts to more than twice the profit going to the oil company. When Creepy Joe Crooked Biden says he going to take the windfall profits, remember this the government is already taking more money than the profits earned now. Those profits belong to the oil companies and their shareholders, not the government.